From products to sales and even customer reports, the world is your oyster regarding which profit reports to use.

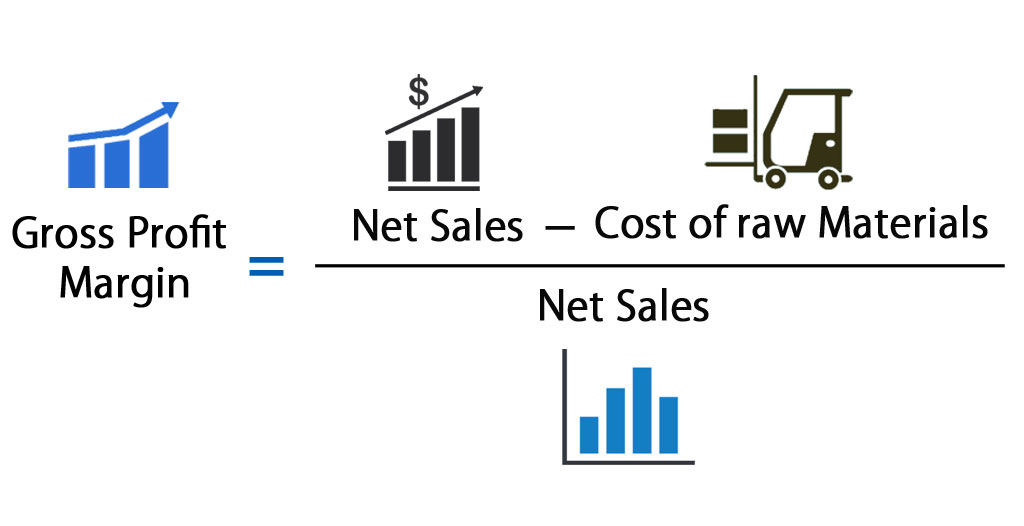

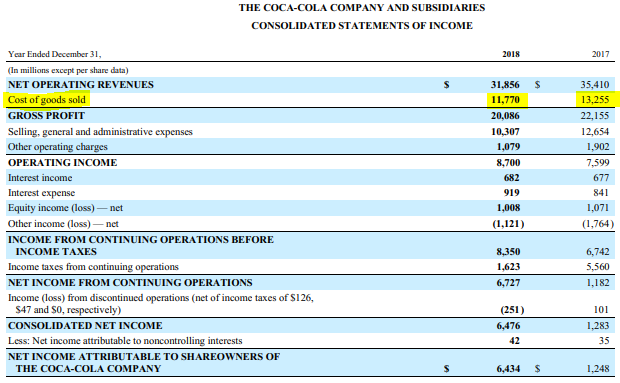

When evaluating how profitable your business is, there are several different reports you can use to segment the data. The benefit of using gross profit margin as a financial metric is that you are easily able to determine the value of your inventory and resulting profit, whilst avoiding disruption to your operations. Gross Profit = Sales revenue – Cost of Goods Sold (COGS) + Direct expenses (variable costs) Your gross profit is calculated simply by dividing gross profit by revenues like so:

Cogs margin full#

Businesses are able to see the value of their stock without performing a full count. Put simply, your gross profit margin is the money left over from revenue after you’ve accounted for the total cost of goods sold (COGS). The gross profit margin method provides an alternative.

Performing a precise inventory count can prove costly and disruptive to your operations, requiring staff from across the business to take part – siphoning resource away from customer facing activities.įor any business, it’s not ideal. Let’s say your business is looking to value the amount of stock left in your warehouse. To begin, let’s discuss what gross profit margin actually is and what it can show us. Actionable advice to improve the accuracy of your reporting.The differences between gross and net profit.This guide aims to equip you with the knowledge you need to understand your Gross Profit Margin and profit reporting, plus some actionable advice you can take away for how you can improve your reporting.

To make the day-to-day decisions that are going to grow your business, you’ll need much more detail, and you’ll need it to be up-to-date and available at any time. Profit is surfaced on the Income Statement (Profit and Loss report), but usually only at a company level. If you deal with managing your business finances on an ongoing basis, one of the first things you need to know is whether you are profitable.

0 kommentar(er)

0 kommentar(er)